housing allowance for pastors 2022

So if youre receiving 5000 in a housing allowance and the fair market rental value of the home dips to 4000 you can only exclude 4000 from your gross income. A pastors housing allowance must be established or designated by the church or denominational authority.

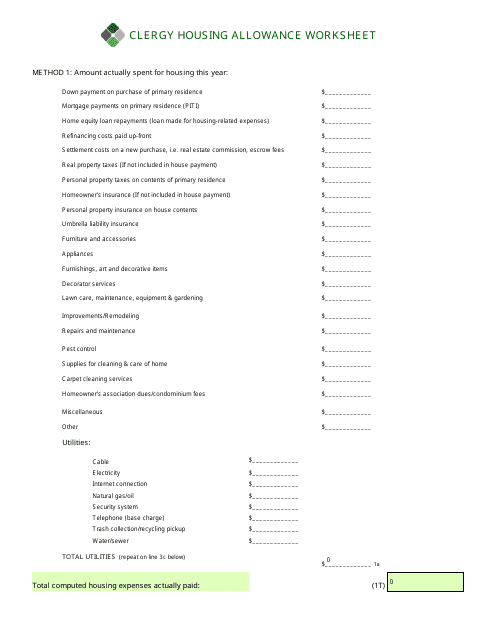

Housing Allowance Worksheet Fill Out And Sign Printable Pdf Template Signnow

Not every staff member at the church can take this allowance.

. For 2022 the cost for CRSP to the church is 103 of pension plan compensation and. For tax purposes this allowance is exempted from the recipients gross income. This portion of the ministers salary is excludable from gross income for income tax purposes but.

It is time again to make sure you update your housing allowance resolution. Perhaps one of the least understood tax benefits a housing allowance also called a parsonage allowance or rental allowance is defined as a designated portion of a ministers salary that is used toward expenses incurred in providing housing. Ministers housing expenses are not subject to federal income tax or state tax.

Here are four important things that you need to know concerning the housing allowance. If your mortgage payment is 2000 a month but you could only rent the home for 1500 then your housing allowance is limited to 1500 a month. If your minister lives in a church-owned parsonage.

Maximize your deductions now and learn what you need to do to keep housing allowance. A ministers housing allowance sometimes called a parsonage allowance or a rental allowance is excludable from gross income for income tax purposes but not for self-employment tax purposes. Section 107 of the Internal Revenue Code clearly allows only for.

But if your church has only designated 1450 a month for your housing allowance then thats the most you can claim. The call includes an annual housing allowance of 10481 874 per month. Pastors Housing Allowance Worksheet.

From the pastors gross income in that calendar year. Housing Manse Parsonage Designation. And it is further.

Thursday May 5 2022 Edit. Ministers housing expenses are not subject to. Many ministers miss out on potential savings because they dont understand all thats available and how to use it.

The housing allowance for pastors is not and can never be a retroactive benefit. Pastoral Housing Allowance for 2021. The housing allowance is for pastorsministers only.

According to tax law if you are planning to claim a housing allowance deduction actually an exclusion for the upcoming calendar year your Session is required to designate the specific amount to be paid to you as. Sample Housing Allowance for Pastors Ready-to-use resolution language for church board to set a clergy housing allowance in 2022. If you own your home you may still claim deductions for mortgage interest and real property taxes.

In this situation that extra 1000 has to be included as part of your wages on line 7 of your Form 1040 US. 3 of salary housing. With an annual salary of 34681.

3 of salary housing. Individual Income Tax Return. 3 of salary housing.

However AGFinancial automatically designates 100 of a ministers MBA 403 b distributions as housing. The housing allowance exclusion only applies for federal income tax purposes. With some denominations retirement plans a minister must first ask to have a percentage of their distributions declared as housing prior to being able to receive the tax break.

Many miss the opportunity and more than a few make some critical mistakes. The Regulations require that the housing allowance be designated pursuant to official action taken in advance of such payment by the employing church or other qualified organization. If you receive as part of your salary for services as a minister an amount officially designated in advance of payment as a housing allowance and the amount.

Get everything done in minutes. Only expenses incurred after the allowance is officially designated can qualify for tax exemption. The church will reimburse for utilities including basic telephone and cable TV charges estimated to run approximately 3495 annually.

For less than fulltime pastors housing is a component of compensation to be negotiated between the pastor the church and the District Superintendent. It is then up to the minister to determine and report the. Ministers who live in a church-provided parsonage or manse can exclude from their income for federal income tax reporting purposes 1 the fair rental value of the parsonage and 2 the portion of their compensation designated in advance by the church as a parsonage allowanceto the.

3 of salary housing. 10 Housing Allowance For Pastors Tips 1. If a church withholds FICA taxes for a.

Ministers Housing Allowance is a valuable lifelong financial tool if managed properly. In that case at most 5000 of the 10000 housing allowance can be excluded. Therefore it is important to request your housing allowance and have it designated before January 1 so that it is in place for all of 2020.

Churchescharges providing a housing allowance in lieu of a parsonage should follow the Conference. Below are five simple steps to get your clergy housing allowance worksheet 2022 eSigned without leaving your Gmail account. Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor.

If you find that the lowest number is your designated housing allowance that. 1 A parsonage allowance may also be called a rental allowance or housing allowance. A ministers housing expenses to be tax-free compensation to the minister when the church properly designates a housing allowance.

All states except Pennsylvania allow a ministers housing expenses to be tax-free compensation. Start with these quick videos. 3 of salary housing.

The preferred way to do this is for the church councilboard to adopt a housing allowance resolution prior to each calendar year or prior to the arrival of a new pastor and record the resolution in the minutes of the meeting. Resolved that the total compensation paid to Pastor FirstLast Name for calendar year 20__ shall be Pastors Compenstation 00000 of which Amount 00000 is hereby designated as a housing allowance. Resolved that the designation of Amount 00000 as a housing allowance shall apply to calendar year 20__ and all.

A parsonage allowance is a sum of money awarded by the same governing board of a house of worship to its minister to offset housing expenses. The IRS allows a ministers housing expenses to be tax-free compensation to the minister when the church properly designates a housing allowance. Can the housing allowance resolution be adopted or amended mid-year.

Church Pension Group Clergy Housing Allowance

The Minister S Housing Allowance

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church The Pastor S Wallet

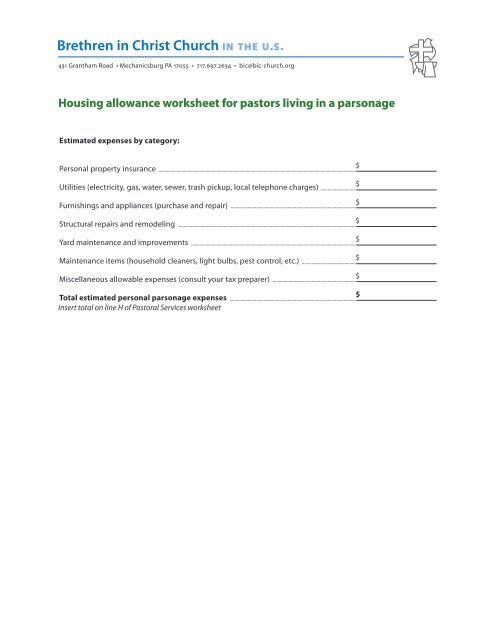

Housing Allowance Worksheet For Pastors Who Live In A Parsonage

2022 Housing Guide Pdf Download Clergy Financial Resources

Clergy Housing Allowance Worksheet 2010 2022 Fill And Sign Printable Template Online Us Legal Forms

Housing Allowance What You Need To Know The Better Way Planning Financial Support Why Is Planning Financial Support Important To Ensure Church Funds Ppt Download

What To Do If Your Clergy Housing Allowance Exceeds Your Actual Expenses The Pastor S Wallet

Video Q A Do Additional Principal Payments Qualify For The Housing Allowance The Pastor S Wallet

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church The Pastor S Wallet

Housing Allowance For Ministers Cbf Church Benefits

Pastoral Housing Allowance Fill Online Printable Fillable Blank Pdffiller

Housing Allowance Worksheet Clergy Financial Resources Download Fillable Pdf Templateroller

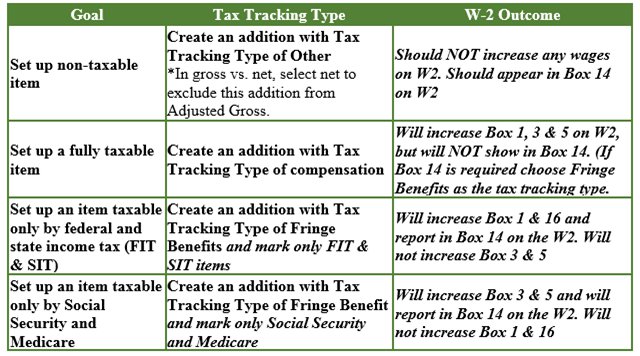

Payroll Set Up Housing Allowances For Clergy Members Insightfulaccountant Com

Fillable Online Agncn Housing Allowance Request Ncn Assemblies Of God Agncn Fax Email Print Pdffiller

Claiming A Minister S Housing Allowance In Retirement The Pastor S Wallet

Housing Allowance Worksheet Clergy Financial Resources Download Fillable Pdf Templateroller

0 Response to "housing allowance for pastors 2022"

Post a Comment